The key concept

Most people live paycheck to paycheck. Their only source of income being their salaries and adjusting their expenses to match it, leaving them with close to nothing by the end of the month. Sometimes spending more than their income and financing the balance with debt, which just adds to the future expense burden. This cycle of bad money management leaves them unable to save for a home or retire with dignity. The issue is not the size of the paycheck, but rather a behavioural problem caused by bad habits and financial illiteracy.

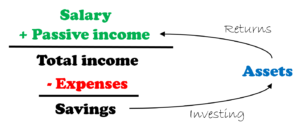

Sound personal finance is based on one, very simple but powerful rule: “Live on less than you make and invest wisely your savings”.

Saving a portion of your income regularly allows you to invest and build new sources of income besides your salary. As your investments grow, so does the additional income they produce for you. When the income from investments exceeds your expenses, you no longer need a salary or a job to sustain your lifestyle, your wealth

Top Free Tools

Net Worth Calculator

Check your Assets and Liabilities

Personal Budgeting Tool

Prepare your monthly budget with our top

Income Tax Calculator

Calculate your after tax salary